| The property ‘bubble’ — Part 1

Published

Thursday 22nd April, 2004

The people who actually produce the properties are themselves

having their behaviour changed by the new environment in terms of the

appraisal they make before investing in a project.

For several weeks, workmen have been busy at the

Deluxe Cinema site located at the corner of Pembroke and Keate

street. No one can confirm exactly what is going to be built there,

but entrepreneur Johnny Soong has been seen there on several

occasions. Word around town is that a new entertainment centre will

replace the old cinema. Photo: Karla Ramoo

This week we move onto the main topic in the minds and mouths of

those of us in the property business. The Business Guardian’s Editor has

called this the property “bubble” and some of the main questions

investors and owners are asking are — For how long can property prices

keep rising this way? Are we about to experience a crash? For those

outside the circle of property owners, the questions are more pained —

With the other increases in the cost of living, will our wages ever

allow us to save a deposit for a home? Will we ever be able to afford

our own homes? Do we have to pay rent forever?

Let us say right away that it is impossible to answer any of those

questions for certain in this column, but this week we will start to

discuss some of the main features of this stage of the property market.

One could well ask whether all good things must come to an end. But it

is also interesting to consider whether these steep price increases are

really a good thing..

These would need to include —

What is the market? — Many of the calls for an explanation of

this extremely dynamic market seem to be based on a “western peninsula

perspective,” but it has never been the intention of this column to

focus so narrowly on such an important market. The property market and

the price movements in it affect all of us in this small country. Either

as homeowners and hopeful homeowners or as business people who have to

pay rent and people who want to open businesses, we are all “in the same

boat.” If the scarce resources of the construction industry are engaged

in building large projects — such as those by UDeCOTT, NIPDEC, HCL and

our other property developers — there will be increased costs to those

undertaking other projects, such as the building of their own homes.

These would include the emergence of less competent contractors, the

present increases in material costs and the logjam in the approval

process. The same principle applies to the scarce resource of land.

Central Bank Monetary Policy Report — The Governor of the

Central Bank recently briefed us on the implications of the present high

levels of liquidity and depressed interest rates in the shape of

property emerging as a preferred investment. The Governor went on to say

that the consequent property price increases are limited to a few areas

only. Our own view is different, as there seems to be widespread

inflation in property prices.

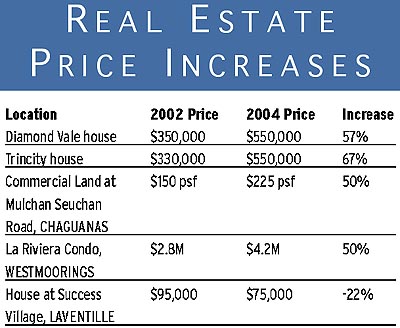

National Increases — As a matter of fact, we do not have the

facts available, in terms of either quantity or quality, to really

construct any kind of index for house prices. Our own attempts in that

direction are private but it would seem that property prices have risen

by over 30 per cent in the last two years or so.

Limited areas with no growth — In making that kind of estimate

one also has to note that only a few limited areas, perhaps six or so,

have experienced no price increases in the last two years.

Vendor/Purchaser behaviour — In this inflationary climate,

both sides in transactions are exhibiting behaviour, which is not

justifiable by the usual yardstick. Purchasers are paying more than a

property is worth, in the belief that today’s overpayment can be

eclipsed by tomorrow’s price increase. Vendors are dominant in this

sellers’ market so they can “call their price” and wait for the right

purchaser. Both sides are making long-term financial decisions on the

basis of future price increases. So far events have justified this

pattern of investment.

Supply-side implications — The people who actually produce the

properties are themselves having their behaviour changed by the new

environment in terms of the appraisal they make before investing in a

project. The project appraisal process would ordinarily involve

analysing a proposal in both pessimistic and optimistic modes — to

establish the best and worst case scenarios. The behaviour of purchasers

and vendors outlined above can result in developers embracing the

optimistic scenarios as a matter of routine. So far so good, but when we

consider the cost increases in the construction sector and other

factors, the risk of mistakes is high.

Next week, we will examine some of the changes, which will affect

the property market in the medium-term, foreseeable future.

|