| Taxing thoughts on housing

Published

Thursday 18th March, 2004

We started this series by looking at housing and the important part

it plays in the property market and society in general.

Apart from being a place for us to work, live, play, eat and so on,

we are all aware of the vital role property plays as an investment. Yes,

many people own their homes or business-places and enjoy benefits

reaching beyond occupation. For example, one of those extra benefits

enjoyed by property owners is the opportunity to borrow against the

equity in their property - equity being the difference between what is

owed to the bank and the present value of a property - to do any number

of things. These would include education, further improvements to their

property, travel, repayment of other debts and so on.

There is little doubt that property is one of the principal

investments in our country. Most people's borrowings, whatever the

ultimate purpose of the funds, are secured by property and most

families' wealth is largely held in property.

In an earlier column on how the State finances housing we outlined

the principal tax benefits available to those who invest in housing. In

the next few columns we will examine some of the taxes to which property

owners and occupiers are liable.

Property owners form an important part of the modern economy and

indeed, some would even argue that the property-owning middle class is

the backbone of the stable state to which we ought to aspire. That state

is sometimes said to exist as a series of 'social contracts' in which

those of us who 'play by the rules' agree to study hard, work hard and

raise a family the best way we know how. The other side of the deal is

that we abide by the law, pay our taxes and in return, expect the state

to provide us with adequate basic services - health, education, security

and justice, transportation networks and so on - which all work together

to enhance the quality of life for us all. The stability and possibly

enhancement of property values would be part of that 'quality of life'

enjoyed by property owners.

Of course this is just a popular idea of how society works and there

is presently a great deal of thought as to the actual relation, if any,

between increasing material well-being and the development of a good

society. Some say that as people get more comfortable the society

improves, while others contend that, when one thinks about the

wealthiest societies, there is plenty of room for doubt on that score.

The principal point here is that property owners expect, rightly in

my view, a high level of support from the State since this will be to

their ultimate benefit. The corresponding question of whether, as a

group of beneficiaries, they are equitably taxed is a potent one.

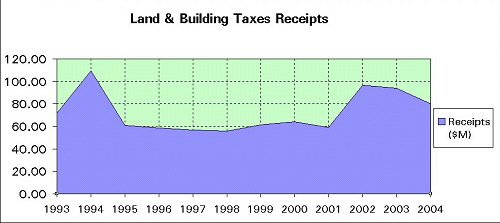

As an introduction to the

discussion on Land and Building taxes, I have included the graph

above, showing the actual Land & Building taxes collected by the

State for the years 1993-2004 (the 2004 figure is an estimate);

these figures were obtained from the Estimates of Revenue published

by the Ministry of Finance. When we consider the basis on which this

tax is charged and the significant increase in property development

over the last decade, the graph tells an interesting story. Even if

we make the unrealistic assumption that no properties at all were

built in the 10-year period under examination, there is still a

significant fall in this revenue in the period 1995-2001; we see

receipts of $109M in 1994, followed by a fall to $61M in 1995 and a

continuation of that broad level of income (say $60M) until 2002

when receipts rise to $96.5M. Making the reasonable assumption that

the figures are correct, we would need to understand the probable

reasons for this drop in collections levels. The causes may be poor

collections efforts by the responsible officials, poor estimates by

the same parties - for example, the estimated receipts from this tax

fall from $127M in 1995 (when only $61M was actually collected) to

$68.1M in the next year (when $59M was actually collected).

Let us look at the three main property taxes:-

Occupation Tax - Land & Building Taxes are charged for each

year the property is occupied; this is supposed to be based on the

annual rental value. The estimates of annual rental value ought to be

updated regularly so as to ensure that the figures keep pace with

changes in value and that will be discussed in another column in this

series. This area of property taxation is sorely in need of review to

properly reflect the rising level of property values we are all aware

of.

Transfer Tax - This is called Stamp Duty and is payable by the

purchaser of property; this is supposed to be based on the proper

consideration for the property. This is also to be addressed in this

series.

Income Tax - If income is earned from property rental, this

ought to be declared in an individual's tax return. There are a number

of investors who earn rental income from properties in their ownership;

this will also be addressed in this series.

There is no Capital Gains Tax payable on the profit made when

property is sold for more than its purchase price after allowing for

improvements.

Next, we will be examining the issue of taxation on property and

the future of our cities. |